The initial results from this will be the success rate, the new median effects, and the base 10percent influence.

Just why is it Titled a Monte Carlo Simulation?

While the all bargain disperse hobby, certainly because of the cash, had been just starting later and soon after cycles of the identical firms that was terrific enterprises. They’re reduced fantastic now being foie gras-ed vast sums out of cash, but it was not regarding it Cambrian burst of new info and in what https://happy-gambler.com/space-wars/rtp/ way that we knowledgeable, for example, fintech inside ’15, ’16 and you may ’17. The very first is very in order to define the important points on the floor as they remain now. We’ve already been calling it the new “Fog of Combat” for hours on end, and it do getting certainly, at least in the board conferences that we’m in the plus the investment committees I’meters inside the, they feels like a maybe not unprecedentedly, but disproportionately, foggy go out.

Sales Convention 2025

Zooming out a little bit, that which we do know would be the fact there didn’t was once a great fintech world. For some time, long time, when Hans is running economic characteristics and fintech during the Standard Atlantic, for instance, and if I found myself working within my prior business, fintech wasn’t most to your radar display screen. So we’ve already come to find once again — because the group inside space surely provides experienced — a refuge from the levels of 2021. Greece’s “samosisland” is the biggest champ of all of the finished Small EPT Monte-Carlo events, courtesy of delivering on the 55 Zero-Restrict Hold’em 8-Max Extremely Large Roller. Certain 2,888 players bought in and you can created a good 144,400 prize pond, that was more than 3 times how big the new stated 40,one hundred thousand make certain. One seasons marked the start of an excellent 17-12 months offer from zero industry gains when you to items inside the inflation.

David try adequately proficient in of several elements of monetary and you will courtroom research and you may publishing. Since the an enthusiastic Investopedia reality checker while the 2020, he’s got verified more 1,one hundred blogs for the an array of economic and you can money information. The new Light Coat Buyer is full of listings similar to this, whether it’s increasing your monetary literacy, appearing you the best actions on your road to financial achievement, or revealing the subject of mental health. To see how much The fresh White Layer Investor will help you on your own economic excursion, begin right here to read through a few of all of our top posts also to come across everything else WCI provides. And if you are inspired to construct a robust economic basis, make sure to sign up for our WCI 101 current email address show. The brand new PokerStars Eu Casino poker Journey (EPT) Monte Carlo festival is actually started inside the scenic Monaco, and PokerNews’ real time reporting people is on the floor providing you with live and you may private visibility of seven of the schedule’s most significant events.

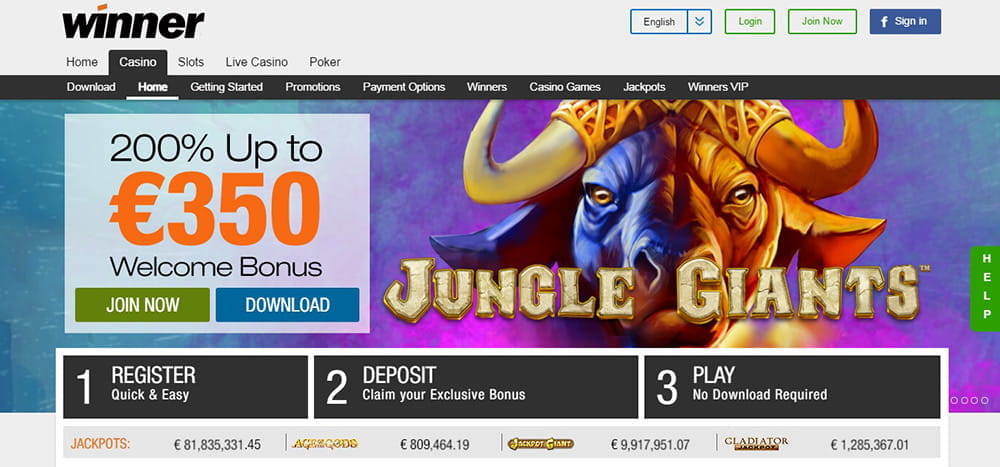

End the newest Small EPT Monte Carlo Collection for the a top Having a welcome Extra

There are numerous a way to estimate how much money your can be withdraw in the retirement. A Monte Carlo investigation is one way to help you estimate exactly how almost certainly it is you will have adequate money for senior years. Matthew Pitt originates from Leeds, Western Yorkshire, in the uk, and has worked on the casino poker world because the 2008, and you can worked for PokerNews while the 2010.

- To understand more about the possibility effect of them reduced go back presumptions, we are able to consider ten,100 the brand new Monte Carlo simulations utilizing the same simple departure (11.2percent) but a lower indicate genuine go back (2percent), after which evaluate the new Monte Carlo leads to genuine historic conditions.

- There are many different a method to calculate what kind of cash your can be withdraw in the old age.

- Preferably, Monte Carlo analysis equipment would allow a combo – including shorter real efficiency to have ten years, followed closely by normalized output which have mean reversion – but, unfortunately, zero financial planning application is yet built to give including program-dependent Monte Carlo projections.

- David is comprehensively proficient in of a lot aspects of monetary and you may court look and you will posting.

- And therefore it graph shows what one to X wants in reverse in the these types of offered ages.

While many studies have shown you to definitely daily and monthly stock production appear to have fatter tails, whenever estimated annually (as is common within the monetary planning forecasts), the new disadvantage body weight tails largely disappear. While the graph reveals, the best and poor Monte Carlo situations (0th and 100th percentiles) were actually a lot more high than any real historical finest otherwise terrible scenario. For the Monte Carlo investigation, the new terrible-situation retiree condition went from currency since just fifteen years to the later years, whilst the exact same investing rates never ever indeed ran out in all 114 running 29-seasons historic scenarios. On the other hand, within the best Monte Carlo circumstances, the fresh retiree passed away which have nearly 27 million within the actual money, while the better case historic circumstances completed with “just” six million of rising prices-modified riches in the bottom. The following graph summarizes the new stop genuine riches beliefs in the various percentiles. The standard economic advice about somebody planning on 3 decades within the later years would be to withdraw cuatropercent of old age discounts in the first seasons away from later years (age.g., 4percent of five-hundred,one hundred thousand is 20,000) while increasing the fresh withdrawal amount because of the step threepercent a-year to save speed that have inflation.

The money development is dependant on the real you to-season interest rate. All of this originates from Early Old age Today’s SWR Toolbox v2.0. It needs to be a date variety long enough to incorporate booms and busts. It has to were times when bonds outperformed brings and you can holds outperformed securities. Merely wear’t restrict your date variety in order to a market work with-upwards (such as 1920s, 2010s) and you can assume one to help you echo fact. Your increase your financing by the a secured asset allowance one to shows the brand new stock, bond and money split thereon cards.

Monetary advisors usually have fun with formal application so you can at random alter the price away from go back to security an array of you can effects. With every transform, the software facts how much money you’re remaining which have at the end of its life. While the chart suggests, so it terrible-case historical 31-year sequence didn’t exit to a initiate (as you’d assume, considering the impression away from succession of output). After ten years, the typical annual substance growth rate of your own portfolio try negative. And therefore, immediately after bookkeeping for rising prices (and you can without provided taxation or charges), an excellent retiree with a great 60/40 portfolio got currently moved backward within the inflation-adjusted terms.

Do Monte Carlo Analysis Indeed Overstate End Exposure Inside the Senior years Projections?

Probably one of the most preferred means somebody explore an excellent Monte Carlo investigation is actually for old age thought. To operate a great Monte Carlo simulator, you initially identify the 1st inputs. The newest simulator next determines an arbitrary value in line with the almost certainly choices. Powering the brand new simulator a large number of minutes helps you image the new almost certainly outcomes for your retirement believed and you may pick how most likely you are to have the sequence from return exposure. Notably, the fresh extremes inside seasons-to-seasons annual genuine production of the two scenarios is actually approximately equivalent.